Search

Incoterms® (International Commercial Terms) are a central set of terms used in international trade. The International Chamber of Commerce (ICC) publishes Incoterms® as binding rules that define the transfer of risk, allocation of costs, and other obligations between sellers and buyers in their sales contracts.

Incoterms are available in 30 languages and have become a global standard that forms the foundation of sales contracts.

The most recent edition is Incoterms 2020. Sellers and buyers should explicitly specify in their sales contracts which version of Incoterms governs their agreement. Clearly defining the location for each Incoterm and providing a comprehensive description is essential.

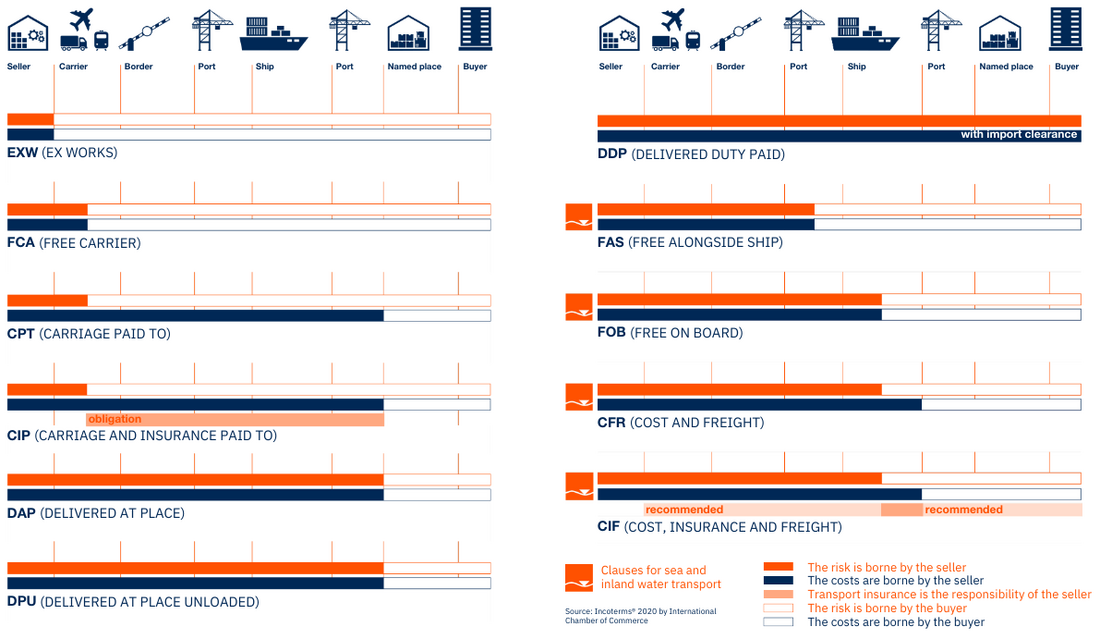

The Incoterms 2020 are categorized into four groups: E, F, C, and D. Each term defines varying levels of obligations for the seller and the buyer. The seller's obligations and risks increase progressively in the following order:

| 1. Group E: | EXW |

| 2. Group F: | FCA; FAS; FOB |

| 3. Group C: | CPT; CIP; CFR; CIF |

| 4. Group D: | DAP; DPU; DDP |

Incoterms can also be categorized based on the mode of transport, distinguishing between multimodal terms and maritime terms:

Multimodal terms are used for all modes of transport (road, rail, air, sea). They include the following Incoterms:

| EXW | Ex Works |

| FCA | Free Carrier |

| CPT | Carriage Paid To |

| CIP | Carriage And Insurance Paid To |

| DAP | Delivered at Place |

| DPU | Delivered at Place Unloaded |

| DDP | Delivered Duty Paid |

Maritime terms apply only to ocean and inland waterway transportation. They include the following Incoterms:

| FAS | Free Alongside Ship |

| FOB | Free On Board |

| CFR | Cost and Freight |

| CIF | Cost, Insurance and Freight |

Download: Click here to download a PDF overview.

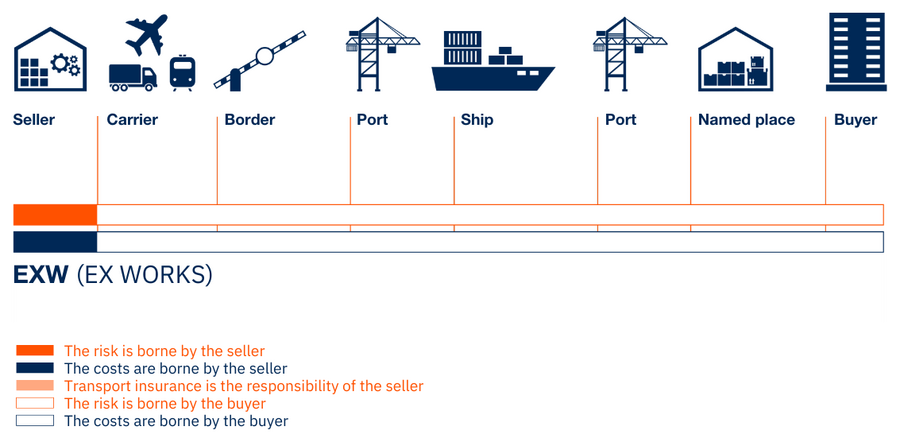

Under the EXW term, the seller provides the goods to the buyer at a specified location. This location may be the seller's premises or another designated site, such as an off-site manufacturing facility or a logistics warehouse.

The goods are considered "delivered" when the seller makes them available. At this point, the buyer assumes both the cost and the risk.

Note: The International Chamber of Commerce (ICC) recommends using this clause only for domestic shipments, as the seller has no obligation to handle customs clearance for export.

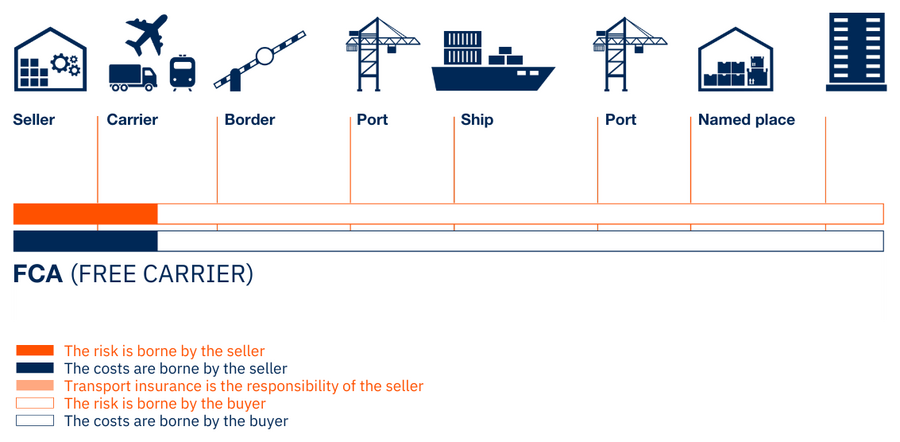

There are two procedures for the FCA term:

The transfer of costs and risks occurs at the time of delivery. The goods are considered "delivered" once they have been loaded onto the buyer's provided means of transportation. From this point forward, the buyer is responsible for all costs and risks.

Cost and risk are transferred at the time of delivery. A seller is considered to have "delivered" goods when:

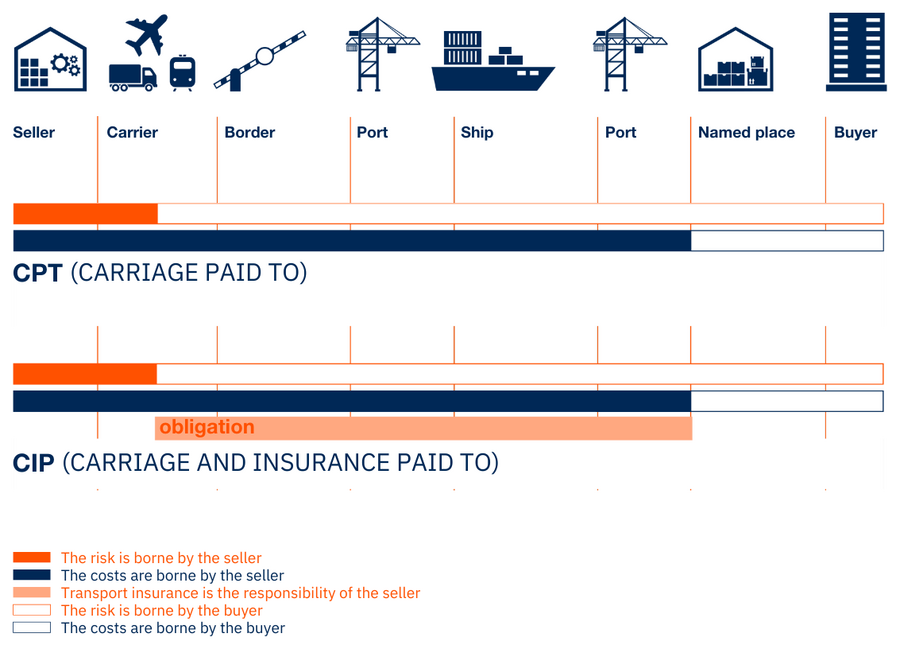

Under CPT, the transfer of costs and risks occurs at different locations.

Cost transfer

The seller arranges and pays for transportation to a specified unloading spot (e.g., ramp 5) at a defined destination (e.g., the buyer's address). From that point on, the buyer is responsible for all costs.

Risk transfer

The seller "delivers" the cargo by handing it over to the carrier they have arranged. At this point, the risk passes to the buyer.

CIP (Carriage and Insurance Paid To) is subject to the same conditions as CPT. Additionally, the seller must provide comprehensive insurance coverage (Institute Cargo Clause A).

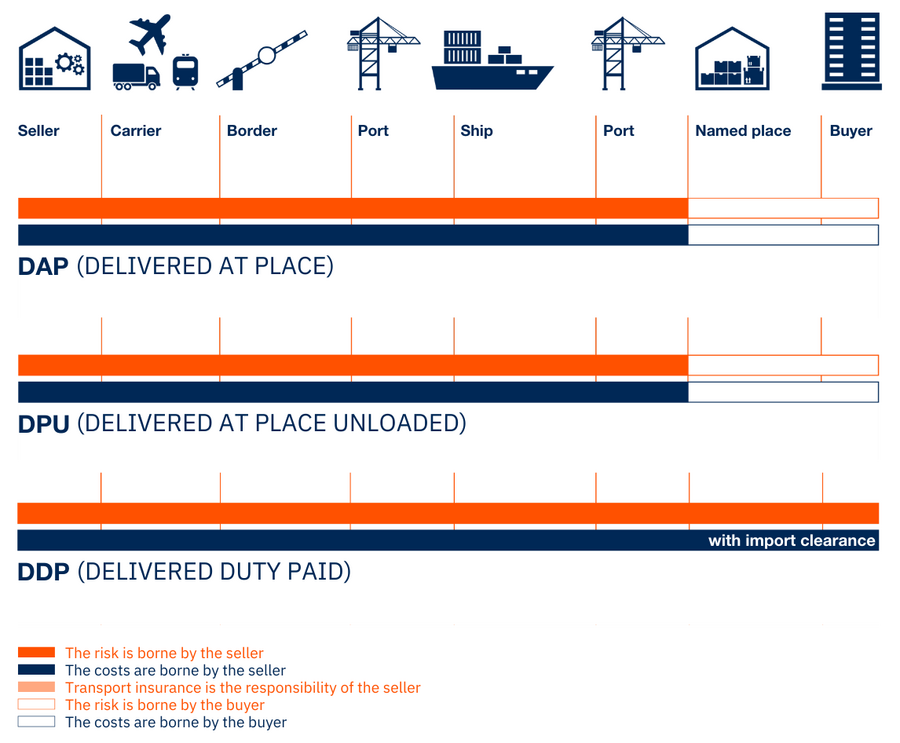

DAP (Delivered at Place)

Under DAP, the transfer of costs and risks occurs at the time of delivery. Goods are considered "delivered" once the seller makes them available at the agreed-upon location, ready for unloading from the seller’s means of transport. From this point forward, the buyer is responsible for all costs and risks.

DPU (Delivered at Place Unloaded)

The key distinction between DPU and DAP is the unloading process. Under DPU, the seller is responsible for arranging and paying for transportation, including the unloading of goods at the agreed spot and destination.

The transfer of costs and risks occurs once the seller makes the goods available at the agreed unloading spot and destination, and they have been unloaded from the seller’s means of transport.

DDP (Delivered Duty Paid)

The key difference between DDP (Delivered Duty Paid) and DAP (Delivered at Place) lies in the responsibility for import customs clearance and payment of duties in the destination country. Under DDP, the seller assumes all costs related to import customs clearance and duties. If the seller does not wish to cover these costs, DAP is the recommended alternative.

The transfer of costs and risks occurs at the time of delivery, once the goods are made available at the agreed location, ready to be unloaded from the seller’s means of transport, and all customs duties have been paid.

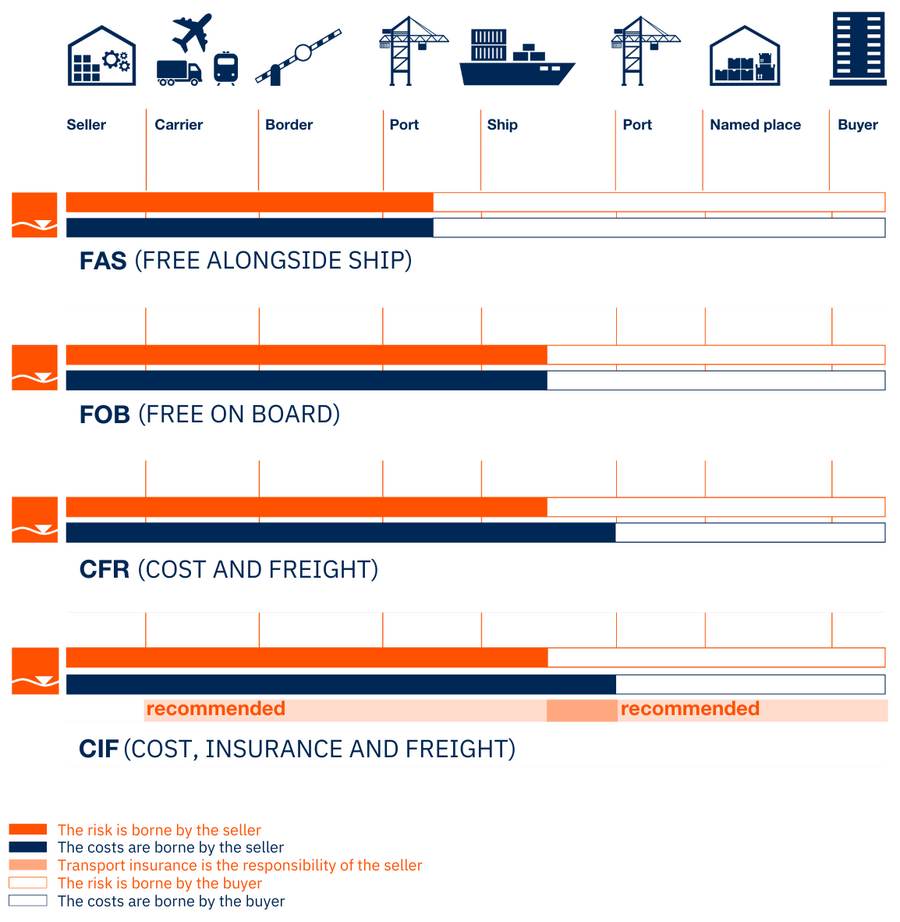

Unlike the multimodal terms described above, maritime terms are only used in sea/inland waterway transport.

FAS (Free Alongside Ship):

The seller assumes the risk of loss or damage until the goods are placed alongside the vessel at the named port of shipment. The seller is also responsible for all costs up to this point.

FOB (Free on Board):

The seller bears the risk of loss or damage until the goods are loaded onto the vessel at the named port of shipment. The seller also covers all costs up to this point.

CFR (Cost and Freight):

The seller retains the risk of loss or damage until the goods are delivered on board the vessel at the named port of shipment. However, the seller is responsible for the transport costs to the named port of discharge and, if specified in the contract of carriage, for unloading costs at the port of discharge.

CIF (Cost, Insurance and Freight):

The transfer of risk and the allocation of costs are identical to CFR. However, CIF also requires the seller to provide insurance coverage from the point of risk transfer to the port of discharge.

In fall 2019, the ICC published a new version of Incoterms, modifying it to align with new global trade practices. Here are the most significant changes:

The Incoterms regulate the following aspects of international trade:

The Incoterms have been regularly published by the International Chamber of Commerce (ICC) since 1936. Their development involves ICC members from 130 countries, including representatives from businesses, chambers of commerce, and international law firms.

Incoterms is short for "International Commercial Terms." It is a registered trademark of the International Chamber of Commerce (ICC) and refers to the set of terms they have developed.

The Incoterms 2020 include 11 terms, divided into four groups: E, F, C, and D. The seller's obligations increase progressively from the E group through F and C to the D group, while the buyer's obligations decrease accordingly.

Incoterms are valid and legally binding only if they are expressly agreed in the sales contract between the buyer and the seller or if they are included in the general terms and conditions. Sellers and buyers must define the Incoterms as clearly as possible, including:

Example: DAP, 10001 New York, 5th Avenue 10, Incoterms® 2020

Previous versions can be agreed upon but must be explicitly stated. If no year is specified in the sales contract, the latest edition (Incoterms 2020) will apply.

For air freight shipments, the following Incoterms are commonly used:

Most Incoterms can be used for all modes of transport. However, the maritime clauses—FAS (Free Alongside Ship), FOB (Free on Board), CFR (Cost and Freight), and CIF (Cost, Insurance, and Freight)—apply exclusively to sea or inland waterway transport.

The Incoterms 2020 define the responsibility for customs and customs costs between the buyer and seller.

Additional customs-related costs in the recipient country may include:

The Incoterms 2020 exclusively regulate the relationship between the buyer and seller. They do not apply to third parties, such as:

However, they may indirectly influence other contracts, such as insurance or transport agreements (delivery terms).

The Incoterms clauses are updated by the International Chamber of Commerce every 10 years. As of now, the Incoterms 2020 are the most recent version.