Search

Reliable air freight planning requires up-to-date market information. Our monthly Air Freight Market Update offers a concise overview of rate developments, capacity availability, and other relevant market changes.

| Global Air Cargo forecast 2026 | WACD expects a 2.7% increase in tonnage, while IATA projects a 2.6% increase in air cargo traffic and a 2.4% increase in cargo. |

| Sustainable Fuel | SAF is projected to account for <1% of total fuel consumption in 2026 — a very low level given the commitment to achieving net-zero CO₂ emissions by 2050. |

| Market driver | The Asia-Pacific, Middle East, and South Asia regions will drive the industry, now accounting for more than half of the global volume. |

| Development 2025 | According to WACD, air cargo volumes increased by 4.3%, and IATA reported an increase of 3.6% to 70.0 million tons of freight carried by air. |

| Air Cargo Capacity | Capacity is expected to remain under pressure due to the backlog of ordered aircraft (B777X-F delivery pushed to 2028; Airbus A350F delivery pushed to late 2027). |

| Spot-air cargo rates globally | Spot rates were in 2025 around 3% YoY down. |

For further insights or shipment-specific guidance, speak with one of our local specialists.

For Q1 2026, WACD expects a tonnage increase of around 2.8%.

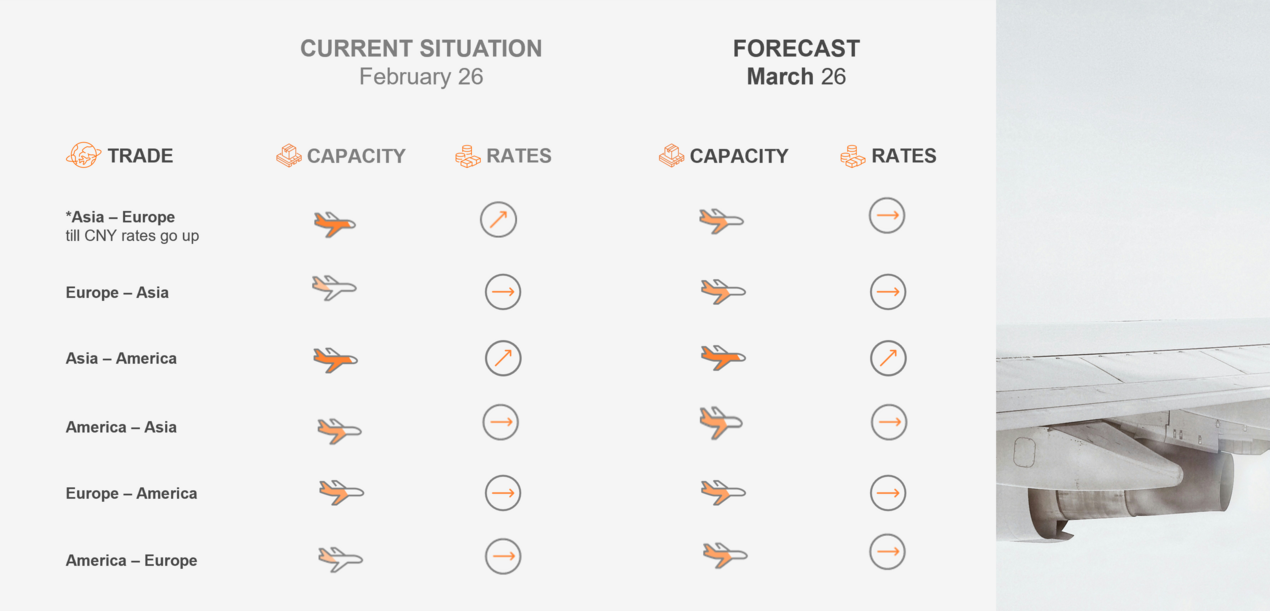

From China to Western Europe, an increase of around 2% is expected in Q1. Overall, spot rates remain flat.

In general, planning and flexibility remain essential. Shippers should review lead times, secure capacity in advance when possible, and closely monitor rate changes. Evaluating alternative routes or service levels may help balance cost and reliability.

Gebrüder Weiss recommends maintaining close coordination with logistics partners to assess market changes and adjust transport strategies accordingly. Regular market updates and shipment-specific consultations support informed decision-making and operational stability.